41 is yield to maturity the same as coupon rate

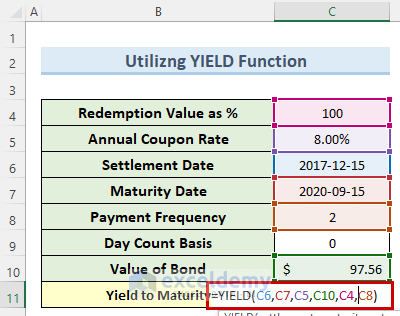

Yield to Maturity – YTM vs. Spot Rate. What's the Difference? Jan 23, 2022 · The spot interest rate for a zero-coupon bond is the same as the YTM for a zero-coupon bond. Yield to Maturity (YTM) Investors will consider the yield to maturity as they compare one bond offering ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia May 20, 2022 · The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate.

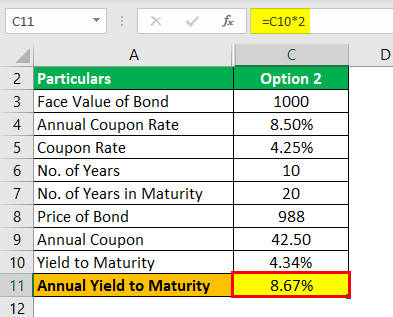

Bond Yield to Maturity (YTM) Calculator - DQYDJ Yield to Maturity Calculator Inputs. Current Bond Trading Price ($) - The price the bond trades at today. Bond Face Value/Par Value ($) - The face value of the bond, also known as the par value of the bond. Years to Maturity - The numbers of years until bond maturity.; Bond YTM Calculator Outputs. Yield to Maturity (%): The converged upon solution for the yield to maturity of the …

Is yield to maturity the same as coupon rate

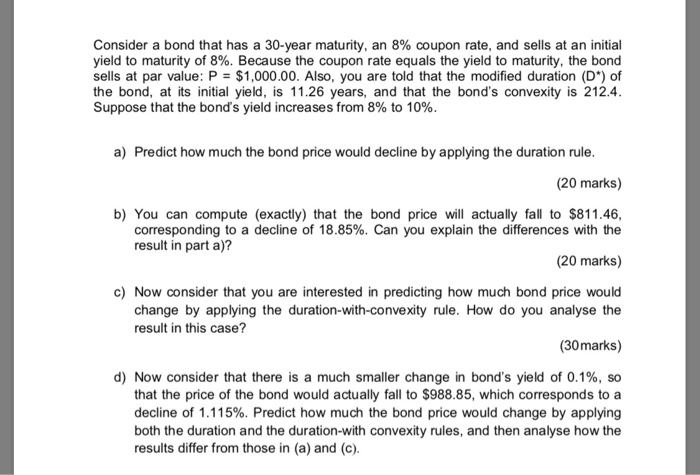

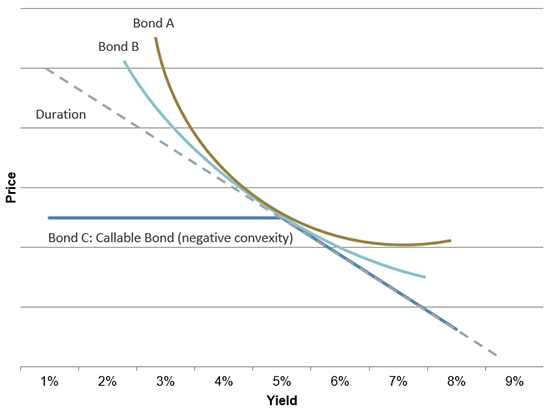

Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Given the choice between two $1,000 bonds selling at the same price, where one pays 5% and the other pays 4%, the former is clearly the wiser option. ... Yield to Maturity vs. Coupon Rate: What's ... What Is Yield to Worst (YTW)? - Investopedia Oct 30, 2020 · Yield To Worst - YTW: The yield to worst (YTW) is the lowest potential yield that can be received on a bond without the issuer actually defaulting. The YTW is calculated by making worst-case ... When is a bond's coupon rate and yield to maturity the same? - Investopedia Jan 13, 2022 · Conversely, a bond purchased at a premium always has a yield to maturity that is lower than its coupon rate. Yield to maturity approximates the average return of the bond over its remaining term.

Is yield to maturity the same as coupon rate. Bond Yield to Maturity Calculator for Comparing Bonds Still, the term persists. The coupon is expressed as a percentage of the bond's face value. So, a 10% coupon on a $10,000 bond would pay an annual interest of $1000. Again, these payments are often staggered throughout the year, so a bond holder's interest might be paid in biannual or quarterly installments. Fixed Rate Bonds – A fixed rate ... Yield to Maturity (YTM): What It Is, Why It Matters, Formula - Investopedia May 31, 2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... What Is the Coupon Rate of a Bond? - The Balance Nov 18, 2021 · Coupon Rate vs. Yield . In contrast to the bond’s coupon rate, which is a stated interest rate based on the bond’s par value, the current yield is a measurement of the dollar amount of interest paid on the bond compared to the price at which the investor purchased the bond. In other words, the current yield is the coupon rate times the ... Important Differences Between Coupon and Yield to Maturity Mar 04, 2021 · Coupon vs. Yield to Maturity . A bond has a variety of ... mind that the coupon is always 2% ($20 divided by $1,000). That doesn’t change, and the bond will always payout that same $20 per year. ... if you buy a bond at a premium, the yield to maturity will be lower than the coupon rate. High-Coupon Bonds The yields for high-coupon bonds are ...

When is a bond's coupon rate and yield to maturity the same? - Investopedia Jan 13, 2022 · Conversely, a bond purchased at a premium always has a yield to maturity that is lower than its coupon rate. Yield to maturity approximates the average return of the bond over its remaining term. What Is Yield to Worst (YTW)? - Investopedia Oct 30, 2020 · Yield To Worst - YTW: The yield to worst (YTW) is the lowest potential yield that can be received on a bond without the issuer actually defaulting. The YTW is calculated by making worst-case ... Bond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · Given the choice between two $1,000 bonds selling at the same price, where one pays 5% and the other pays 4%, the former is clearly the wiser option. ... Yield to Maturity vs. Coupon Rate: What's ...

Post a Comment for "41 is yield to maturity the same as coupon rate"