38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

When is a bond's coupon rate and yield to maturity the same? 13.01.2022 · So if interest rates went up, driving down the price of IBM's bond to $980, the 2% coupon on the bond will remain unchanged. A bond's maturity date is simply the date on which the bondholder ... Latest News - News Viewer - MarketWatch Get the latest stock market, financial and business news from MarketWatch.

Certificates of deposit (CDs) | Fixed income investment | Fidelity Brokered CD vs. bank CD A brokered CD is similar to a bank CD in many ways. Both pay a set interest rate that is generally higher than a regular savings account. Both are debt obligations of an issuing bank and both repay your principal with interest if they’re held to maturity.More important, both are FDIC-insured up to $250,000 (per account owner, per issuer), a coverage …

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

Stock Quotes, Business News and Data from Stock Markets | MSN … 25.10.2022 · Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ... Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Mortgage-backed security - Wikipedia This is likely to happen as holders of higher-coupon mortgages can have a larger incentive to refinance. Conversely, it may be advantageous to the bondholder for the borrower to prepay if the low-coupon MBS pool was bought at a discount (<100). This is due to the fact that when the borrower pays back the mortgage, he does so at "par". If an ...

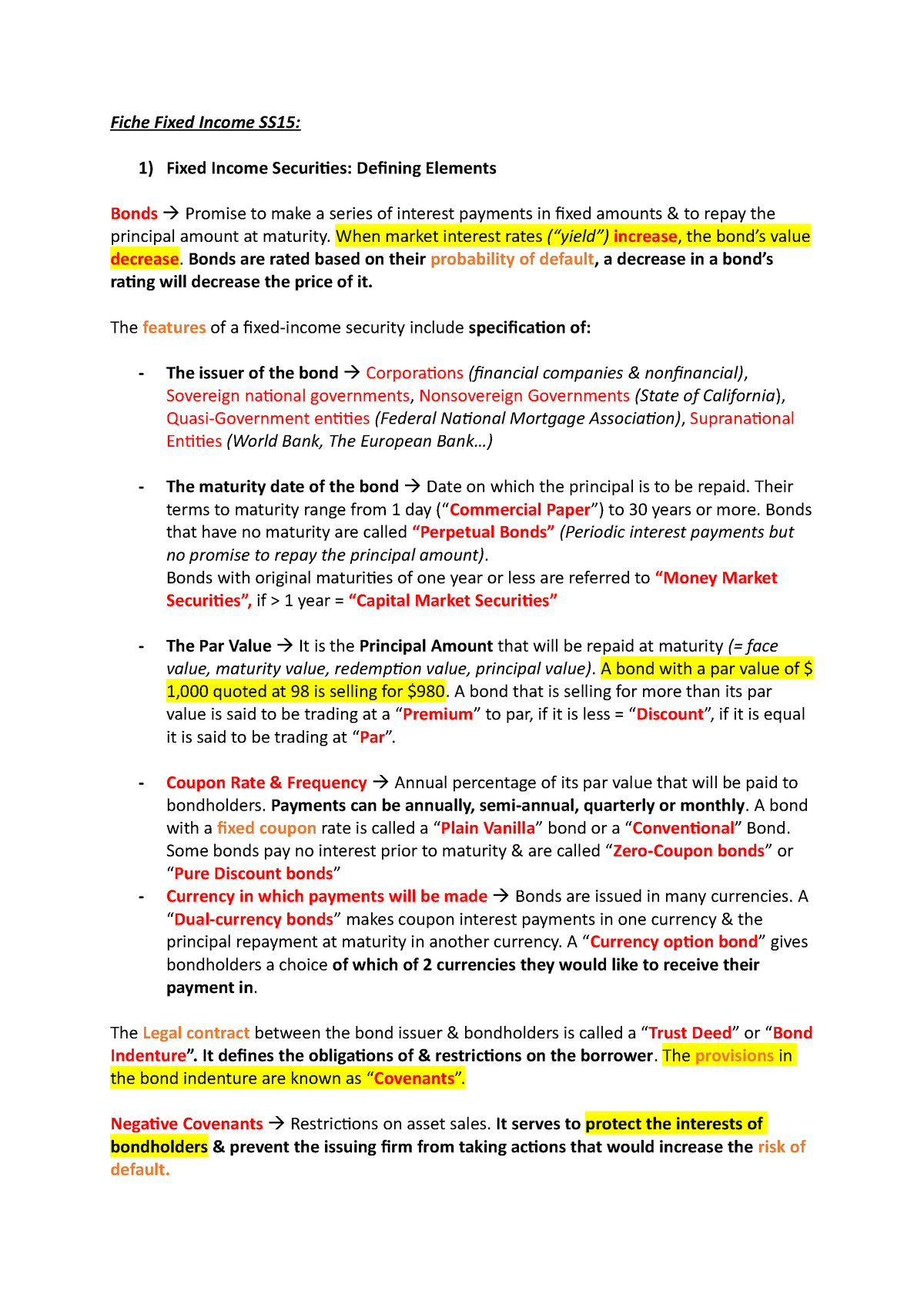

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. Convexity of a Bond | Formula | Duration | Calculation So the price would decrease by only 40.64 instead of 41.83 . This shows how, for the same 1% increase in yield, the predicted price decrease changes if the only duration is used as against when the convexity of the price yield curve is also adjusted.. So the price at a 1% increase in yield as predicted by Modified duration is 869.54 and as predicted using modified duration … Bond Yield: What It Is, Why It Matters, and How It's Calculated 31.05.2022 · Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Thus if interest rates fall, any outstanding bond which pays an interest rate above the current prevailing rate enjoys capital appreciation, since it is paying a higher rate than an investor could obtain by buying another similar bond at current rates. Since zero coupon bonds do not pay a coupon, any capital appreciation remains in the bond ... Bond: Financial Meaning With Examples and How They Are Priced 01.07.2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

Mortgage-backed security - Wikipedia This is likely to happen as holders of higher-coupon mortgages can have a larger incentive to refinance. Conversely, it may be advantageous to the bondholder for the borrower to prepay if the low-coupon MBS pool was bought at a discount (<100). This is due to the fact that when the borrower pays back the mortgage, he does so at "par". If an ... Bond (finance) - Wikipedia In finance, a bond is a type of security under which the issuer owes the holder a debt, and is obliged – depending on the terms – to repay the principal (i.e. amount borrowed) of the bond at the maturity date as well as interest (called the coupon) over a specified amount of time.The interest is usually payable at fixed intervals: semiannual, annual, and less often at other periods. Stock Quotes, Business News and Data from Stock Markets | MSN … 25.10.2022 · Get the latest headlines on Wall Street and international economies, money news, personal finance, the stock market indexes including Dow Jones, NASDAQ, and more. Be informed and get ahead with ...

Post a Comment for "38 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"