41 risk of zero coupon bonds

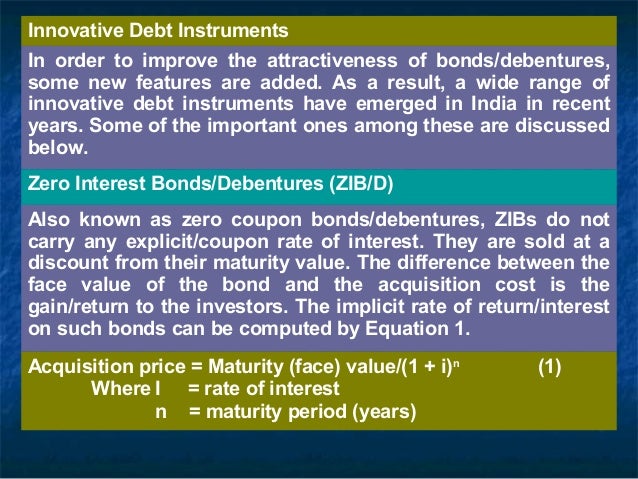

Zero Coupon Bond - WallStreetMojo These Bonds avoid the risk of Reinvestment of Coupon Bonds as Interest Rates keep changing with the passage of time, which impacts the Yield to Maturity of such coupon-bearing Bonds. Since there are no interim cash flows, the investor is assured of a fixed rate of return. #3 - Longer Time frame Zero Coupon Bond Definition and Example | Investing Answers A zero coupon bond is a bond that makes no periodic interest payments and therefore is sold at a deep discount from its face value. The buyer of the bond receives a return by the gradual appreciation of the security, which is redeemed at face value on a specified maturity date. Investors can purchase zero coupon bonds from places such as the ...

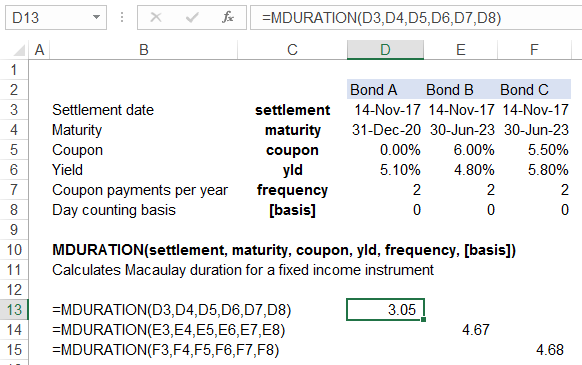

Advantages and Risks of Zero Coupon Treasury Bonds Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros fall significantly...

Risk of zero coupon bonds

What Are Zero Coupon Bonds And Their Risks- Tavaga ... Zero-Coupon Bonds can render great returns if used strategically for your investment goal. In absence of any exceptional case, like intermittent coupon payments, Zero- Coupon Bond's yield to maturity is calculated as: Yield = (FV/PV) 1/n - 1 Where, FV = Face value PV = Present Value n = number of periods Example Default Risk and the Duration of Zero Coupon Bonds nor default free. Little (1984) has examined the case of default-free taxable zero coupon bonds. This paper focuses on the second case, nontaxable zero coupon bonds subject to default risk, and shows that the interest sensitivity of the option component of the bond gives the risky zero coupon bond a duration less than its maturity. Risk-Neutral Pricing Formula for Zero-coupon bonds with ... As a first step, set the expected payoff equal to 0 where prob_D = probability of default, cur_Px = current price, mat_Px = maturity payment, and R = recovery. Therefore prob_D * (recovery - cur_Px) + (1 - prob_D) * (mat_Px - cur_Px) = 0 results in prob_D = (cur_Px - mat_Px) / (R - mat_Px)

Risk of zero coupon bonds. Solved 12. Price risk and reinvestment rate risk Which of ... Which of the following bonds has the highest reinvestment rate risk? A. Zero coupon bond B. Noncallable 6% coupon bond C. Callable 4% coupon bond D. Callable 6% coupon bond Expert Answer 1) A & B are true It is true that If interest rates increase, the coupon rate on newly issued bonds will decrease. And it is also … View the full answer Advantages and Risks of Zero Coupon Treasury Bonds - The ... Unique Risks of Zero-Coupon U.S. Treasury Bonds Because of their sensitivity to interest rates, zero-coupon Treasury bonds have incredibly high interest rate risk. Treasury zeros can easily fall 30% or more in a single year if the Fed raises interest rates. They also have no interest payments to cushion a fall. Finance Exam 2 Chapter 7 Flashcards - Quizlet A. Bonds are more important capital sources than stocks for companies and governments. B. Some bonds offer high potential for rewards and, consequently, higher risk. C. The bond market is larger than the stock market. D. Bonds are always less risky than stocks. D Bonds are issued by which of the following? A. corporations Should I Invest in Zero Coupon Bonds? | The Motley Fool The downsides of zero coupon bonds For some investors, being more sensitive to rate changes is a negative rather than a positive. If you don't intend to hold your bond to maturity, you have to stay...

Zero-Coupon Bonds: Definition, Formula, Example ... They are safe investment instruments, and have a lower element of risk involved. Long Dated zero coupon bonds are said to be the most responsive to interest rate fluctuations. Therefore, in case of longer time duration (a higher 'N'), it might prove to be profitable for the bond holder. Disadvantages of Zero-Coupon Bonds Assessing Risk - Investing In Bonds Market Risk. As with all fixed-income securities, the yields or interest rates on zero coupon municipal bonds fluctuate, usually in step with general market rates. While the interest on a bond is fixed by the price you paid, newer bond issues may be offered at higher or lower rates depending on prevailing interest rates when they are issued. Zero Coupon Bond - Investor.gov Because zero coupon bonds pay no interest until maturity, their prices fluctuate more than other types of bonds in the secondary market. In addition, although no payments are made on zero coupon bonds until they mature, investors may still have to pay federal, state, and local income tax on the imputed or "phantom" interest that accrues each year. What is a Zero-Coupon Bond? Definition, Features ... Coupon Payment Frequency: The intervals at which the payment of interest is made on the bonds is termed as coupon payment frequency. It is paid semi-annually or annually and even monthly or quarterly in some cases. Advantages of Zero-Coupon Bond. A zero-coupon bond is a secured form of investment when done for the long term.

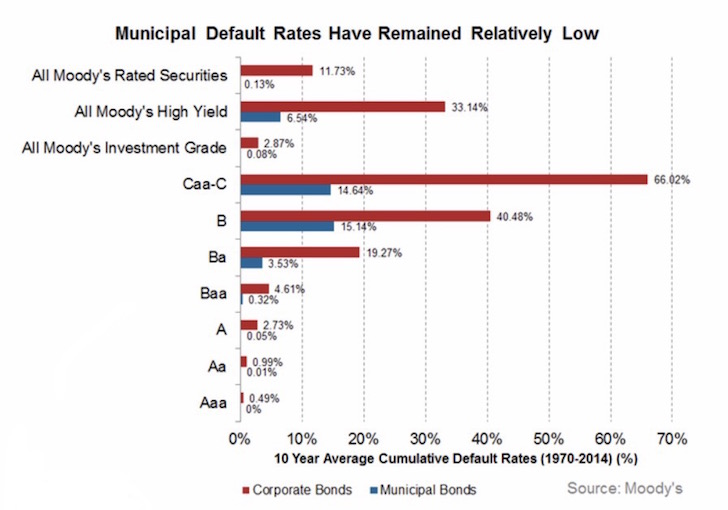

The Pros and Cons of Zero-Coupon Bonds Another problem with zero coupon bonds is that they have a higher default risk than traditional bonds. The reason behind this is that companies do not have to make regular interest payments to the investors. They just keep all of the money and do with it as they please. Solved A risk-free, zero-coupon bond with a face value of ... Finance questions and answers. A risk-free, zero-coupon bond with a face value of $10,000 has 20 years to maturity. If the YTM is 4.6%, which of the following would be closest to the price this bond will trade at? O A. $4,068 B. $5,695 O C. $4,881 OD. $6,509 Consider the following timeline detailing a stream of cash flows: Date 0 2 3 ? $5000 ... Zero Coupon Bond Calculator - What is the Market Price ... Zero coupon bonds are particularly sensitive to interest rates, so they are also sensitive to inflation risks. Inflation both erodes the value of the dollars the bond will eventually pay. In the United States, you need to impute the interest for some zero coupon bonds to pay taxes in the current year (possibly also for state or local taxes). Understanding Zero Coupon Bonds - Part One The major credit agencies rate most zero coupon bonds for credit worthiness. This rating can change during the life of the bond, which can affect the price. The Municipal Securities Rulemaking Board (MSRB) created the Electronic Municipal Market Access , a user-friendly tool to check the credit risk of all municipal bonds and the official ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Like virtually all bonds, zero-coupon bonds are subject to interest-rate risk if you sell before maturity. If interest rates rise, the value of your zero-coupon bond on the secondary market will likely fall. Long-term zeros can be particularly sensitive to changes in interest rates, exposing them to what is known as duration risk.

Basic Investment Principles 101 - From Asset Allocations to Zero Coupon Bonds - Financial Poise

Zero-Coupon Bonds: Pros and Cons Higher Yields: Firstly, zero-coupon bonds are perceived as higher-risk bonds. This is because investors pay money upfront and then do not have much control over it. Also, since the money is locked in over longer periods of time, the perceived risk is more.

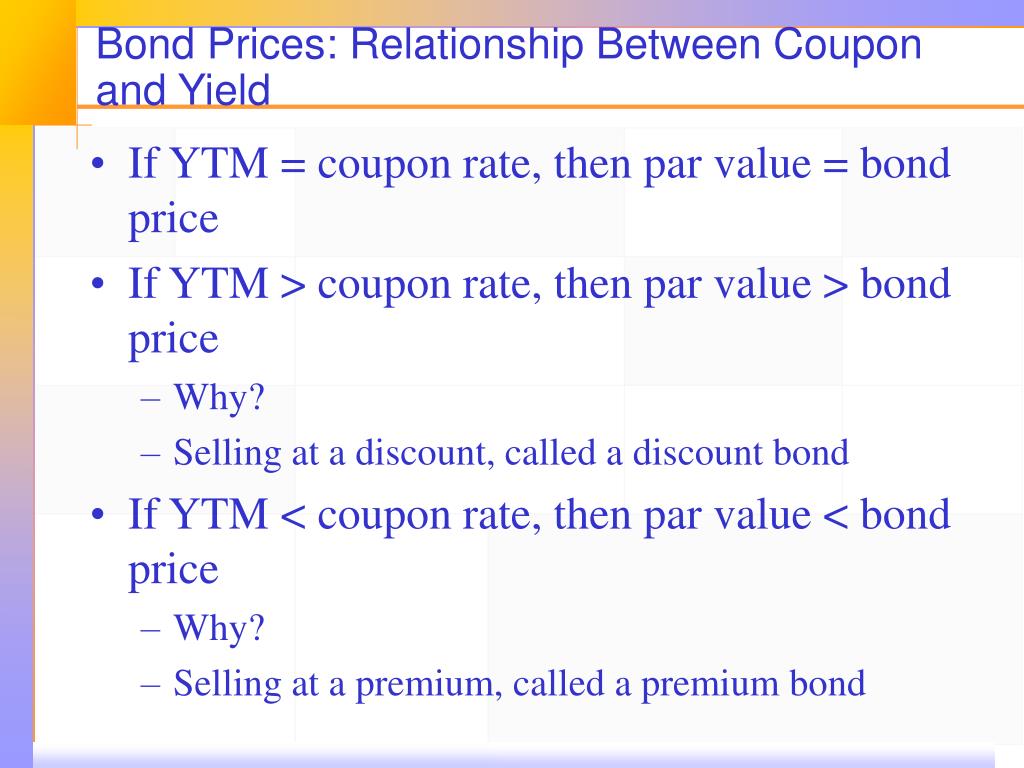

6.2.1 Flashcards - Quizlet The current zero-coupon yield curve for risk-free bonds is shown above. What is the price of a zero-coupon, four-year, risk-free bond of $100? A) $85.64 B) $87.99 C) $92.15 D) $96.67 B) Price = (Face value) / (1 + YTM)N; Price = ($100) / (1 + 3.25%)4 = $87.99. The current zero-coupon yield curve for risk-free bonds is shown above.

How to Calculate a Zero Coupon Bond Price | Double Entry ... The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Zero-Coupon Bond - Definition, How It Works, Formula A zero-coupon bond is a bond that pays no interest. The bond trades at a discount to its face value. Reinvestment risk is not relevant for zero-coupon bonds, but interest rate risk is relevant for the bonds. Understanding Zero-Coupon Bonds As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value.

Zero-Coupon Bond Definition - Investopedia Zero-coupon bonds are like other bonds, in that they do carry various types of risk, because they are subject to interest rate risk if investors sell them before maturity. How Does a Zero-Coupon...

Managing Risk With Fixed Income: How to Buy Zero Coupon Bonds Managing Risk With Fixed Income: How to Buy Zero Coupon Bonds Today's topic of U.S. Treasuries was inspired by a small group of individuals on Physician on FIRE's Facebook group called FatFIRE . If you are a frequent reader of Physician on Fire and not a member of this Facebook group, you are passing up some real value.

Zero Coupon Bond Value Calculator: Calculate Price, Yield ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Post a Comment for "41 risk of zero coupon bonds"